Fairtrade Food Labels: Consumer Preferences & Willingness to Pay

Telechargé par

l.perchicot

Ethical food labels in

consumer preferences

Katharina Bissinger and Daniel Leufkens

Institut of Agricultural Policy and Market Research, Justus-Liebig-Universität,

Gießen, Germany

Abstract

Purpose –Since fairtrade labels are upcoming market instruments, the purpose of this paper is to identify

and quantify consumers’willingness to pay for fairtrade coffee products and tea. Thereby, this paper

contributes to the discussion in favour of a non-private regulation of ethical food labels (FLs). Moreover, the

paper provides information about the consumer behaviour of the German buying public.

Design/methodology/approach –The empirical analysis is based on homescan panel data of

13,000 representative German households, which includes actual purchase data of ground coffee,

single-serve coffee, espresso, and tea for a five-year sample period from 2004 to 2008. As a methodological

approach, the hedonic technique is used to model coffee and tea prices as a function of time, store, and

product characteristics.

Findings –Regarding the variables of interest branding a product leads to an average price premium of

22.1 per cent, while the organic FL achieves an average price premium of 34.3 per cent. The highest average

price premium of 43.1 per cent is ceteris paribus paid for fairtrade labels. In the case of fairtrade labels, tea

products earn the highest implicit prices with 74.0 per cent, followed by ground coffee (54.9 per cent), espresso

(24.7 per cent), and single-serve coffee (18.9 per cent).

Originality/value –The present analysis supplements the discussions around the willingness to

pay for fairtrade certified products by the German buying public, a product differentiation between

coffee products and the introduction of labelled tea. As the data set includes daily purchases, it allows

analysis of consumer behaviour on a disaggregated level, given detailed information on prices, stores,

origins, FLs, and so on.

Keywords Hedonic price analysis, Tea, Coffee, Fairtrade, Food label

Paper type Case study

1. Introduction

Lately, food labels (FLs) are a fundamental instrument to determine the buying behaviour of

consumers given that one in three dollars is spent on labelled basic essentials.

Correspondingly, the global market share of labelled products from Germany was about

34 per cent in 2013, solely passed by the market share of labelled products from Great Britain

(41 per cent), Spain (41 per cent) and Switzerland (45 per cent) (Nielsen, 2014). Initially, the idea

behind the introduction of labels into markets was to reduce information asymmetry between

producers and consumers by creating a quality signalling (see e.g. Akerlof, 1970; Spence, 1973;

Stiglitz, 1989). Certainly, asymmetry of information is frequently discussed on food markets,

as consumers are not aware of the products qualities before (“experience attributes”) or even

after (“credence attributes”) consumption (Nelson, 1970). In this context, FLs are interpreted as

signals to indicate the quality attributes of agricultural commodities (Golan et al., 2001).

Moreover, fairtrade[1] labelling pushed the distribution of fairly traded products (e.g. World

Shops) into the mainstream food market (e.g. supermarkets) (Moore, 2004). Nowadays, a new

dimension of quality labels is introduced to national and international retail markets.

This new dimension is depicted as the ethics of a production process and the ethics in trading

intermediate and final commodities. Since ethical or more precisely fairtrade labels are

upcoming marketing instruments the objective of this paper is to identify and quantify the

consumers’willingness to pay for fairtrade coffee products and tea to answer the question

whether a non-private regulation of ethical FLs is feasible. Until now it has lacked empirical

research of actual purchase data of German households.

British Food Journal

Vol. 119 No. 8, 2017

pp. 1801-1814

© Emerald Publishing Limited

0007-070X

DOI 10.1108/BFJ-10-2016-0515

Received 31 October 2016

Revised 22 February 2017

Accepted 8 March 2017

The current issue and full text archive of this journal is available on Emerald Insight at:

www.emeraldinsight.com/0007-070X.htm

1801

Ethical food

labels

Besides, particularly coffee prices are highly volatile in international markets. Within the

research period of this study (2004-2008) the coffee price per pound ranged from USD0.l6,

in 2004, to USD1.29 in 2008. After 2008, there have been more ups and downs and finally, the

coffee price reached a comparable price level in 2017, namely, USD1.43 per pound

( January 2017) (Macrotrends, 2017). Finally, those price fluctuations are smoothed by a fair

floor price to generate a more secure situation for producers in the south (FLO, 2011).

Price fluctuations are less distinct, in the case of the agricultural commodity, tea. However,

tea prices increase since 2004 until 2017 (besides a slight kink in 2005 and a downward trend

since 2012. At the end of our research period (2008), overall tea prices lay by USD2.42 per kg.

In 2016, tea costs USD2.64 per kg on the commercial world market. Since those prices are

still decreasing it is possible that we reach a more comparable level (relatively to 2008) in the

near future (Statista, 2017a).

The empirical analysis of this paper is based on 13,000 representative German

households provided by the consumer research association, Gesellschaft für

Konsumforschung (GfK). The statistics include actual purchase data of ground coffee,

single-serve coffee (coffee pads), espresso, and tea for a five-year period from 2004 to 2008.

As a methodological approach, the hedonic analysis developed by Lancaster (1966) and

Rosen (1974) is used to model coffee and tea prices as a function of time, store, and product

characteristics. The study distinguishes between supply- and demand-side effects and

introduces a new and detailed insight into remarkable, both in sample size and information

content, real consumption data for coffee products and tea certified as fairtrade. For this

reason, the use of actual purchasing data overcomes much of the shortcomings of previous

studies in the field of ethical consumerism. In doing so, the paper shows a high and

significant willingness to pay for fairtrade products. This supports the assumption that it is

necessary to think about regulations in the field of ethical labelling. Accordingly, the paper

continues with a brief overview of the academic literature concerning fairtrade, food

labelling and consumer preferences. The paper is structured as follows. In Section 2,

a literature-based overview is given continued in Section 3 by a description of the data used

in the analysis. After that Section 4 outlines, the conceptual model and Section 5 presents the

empirical results, while Section 6 discusses the findings and policy implications. Finally,

Section 7 concludes the paper and gives directions for future research.

2. Literature review

Section 2 outlines the findings of the current literature on consumer preferences and the

different perception of fairtrade and organic farming in China, Greece, Italy, Sweden,

the UK, the USA, and across national borders. The selection of studies and hence, the choice

of study areas is not only justified by the thematic relevance (WTP, coffee industry)

but also by a study of Andorfer and Liebe (2011), identifying those geographical regions

(the UK, USA, EU, and Asia) as an agglomeration of research on fairtrade. Predominantly,

the academic fairtrade literature spotlights on labelled coffee products (e.g. Loureiro and

Lotade (2005); Didier and Lucie (2008); Maietta (2003); Schollenberg (2012)). Undoubtedly

this list of willingness to pay studies on fairly labelled coffee is a little dated from today’s

perspective. Nevertheless, those studies are still contemporary and unchallenged. However,

they also enable comparison with the results of the study at hand since the research

period is comparable.

The present analysis supplements the discussions around the willingness to pay for

fairtrade certified products by the German buying public, a product differentiation between

coffee products and the introduction of labelled tea.

The conjoint analysis of Loureiro and Lotade (2005) depicts a more advanced willingness

to pay of the American buying public for fairtrade coffee in comparison to organic coffee.

Identical predictions are imposed by the study of Didier and Lucie (2008), whereas the

1802

BFJ

119,8

premium is higher for chocolate. Galarraga and Markandya (2008) confirm those findings with

their analysis of coffee prices in the UK. They predict an increased willingness to pay of

British consumers by 11.26 per cent for fairtrade labelled coffee. Even though they combined

fairtrade and organic farming, they assume the fairtrade premium to be higher than the one of

organic farming. According to Loureiro and Lotade (2005, p. 483): “environmental benefits of

organic production are too abstract (coffee and chocolate)”. Following Loreiro and Lotade the

environmental impact of organic farming is more obvious in the case of other products, like

fruits and vegetable. A plausible explanation could be that those products are mostly sold as

unprocessed agricultural commodities without adding intermediate goods.

On the contrary, Maietta (2003) illustrates a higher willingness of Italian consumers to pay

for organically produced coffee. Within her study, she indicates a price premium of 9 per cent

for fairly traded coffee and a superior price premium of 25 per cent in the case of organic coffee

production. Consequently, the attempt by Loureiro and Lotade (2005) to explain the observed

circumstances is negative, in Italy. A reason for this outcome could be that Italians’

preferences in coffee consumption are slightly different from those of the buying public in

other European countries. There is a reason to believe in such an argumentation since

the coffee culture is highly implemented into the Italian lifestyle. Moreover, it is more

reasonable that consumer preferences vary across country and time. Such a variation, as well

as a diverse image of labels and the local market structure, is more likely to be responsible for

different findings concerning the consumers’willingness to pay. This brief overview of the

current research on the consumer willingness to pay, in regard to fairtrade and organic

labelling, is concluded by three special cases. At first, there is the analysis of Krystallis and

Chryssohoidis (2005). Their research reveals that the Greek buying public is totally

independent of prices and labelling of organic food, no matter which product. This goes in line

with the forgone interpretation and points of a different market structure and a different

average consumer in Greece. Another special case carved out by Schollenberg (2012).

Until now the highest willingness to pay for fairly traded coffee is, with an average price

premium of 38 per cent, registered in Sweden. According to Schollenberg (2012), this result is

highly determined by the political alignment of Swedish consumers and the one-sidedness of

his investigation. Lastly, there is a third case, particularly the Chinese market. Although

the Chinese coffee market is less distinct as in Europe, the price premium reaches an average

value of 22 per cent and thus is highly comparable with the willingness to pay for fairtrade

products of European citizens (Yang et al., 2012). After all, the young Chinese generation

aligns their interests and purchasing choices within the food sector to international markets,

which justifies the increase in coffee consumption in a tea-consuming nation.

To round this brief overview over the willingness to pay of the buying public in different

European, American, and Asian countries off, the results of a transnational study are

provided. Hiscox et al. (2011) analysed the buying behaviour of people buying coffee via the

internet sales platform ebay.com. Within the period between 2007 and 2009 consumers were

willing to pay a price premium of 23 per cent for fairly traded and labelled coffee.

The given literature review leads directly to the main research question of this paper

as follows:

RQ1. What are German consumers willing to pay for fairtrade certified products and

how are they got in the lane with the previous performance?

To answer this question, the paper continuous with the model setup and some

descriptive statistics.

3. Data and descriptive statistics

The empirical analysis of this paper is based on the homescan panel data ConsumerScan

provided by the GfK consumer research association, which is the largest in Germany.

1803

Ethical food

labels

The GfK panel contains food purchase information of about 13,000 representative German

households[2] buying products from retailers and special food shops for a five-year sample

period from 2004 to 2008[3]. As the data set includes daily purchases it allows analysis of

consumer behaviour on a disaggregated level, given detailed information on prices, stores,

origins, FLs, and so on.

Searching for fairtrade labelled products in the GfK panel two commodity categories

could be identified. Those are tea (medicinal, herbal, and fruit) and coffee, while the category

coffee is differentiated in the subcategories of ground coffee, single-serve coffee portions

(pads and capsules), and espresso. Coffee (including espresso) and tea are both fundamental

components of the German beverage market. Coffee (coffee beans, ground coffee, coffee

portions, and soluble coffee) is ranked as the third best-selling beverage in 2015, with a

market share of 49.8 per cent of beverages bought by the German population

(Statista, 2016b). Meanwhile, tea managed rank six (30.9 per cent) at the same ranking

list (Statista, 2016b) and a forecasted of German coffee and tea consumption proclaimed

7.8 liters per capita in 2014. This goes in line with the average annual consumption of coffee

and tea within the entire period from 2004 to 2008, which lay by 7.62 liters per capita

(Groß, 2015). Consequently, preferences of consumers on the German beverage market seem

to be nearly equal over time.

Beyond that, coffee and tea products were two of the first and major commodities in the

field of ethical production debates. Finally, coffee is the first product certified as fairly

traded, whereas the certification of the first tea plantation took place in 2000 (Buser, 2012;

Transfair, 2009). Due to a long history of fairly traded coffee and its establishment within

the fairtrade market, the growth rates of fairtrade certified coffee and tea products

have been steady over time (Fairtrade International, 2015). Furthermore fairtrade certified

coffee ranks highest in fairtrade sales statistics, because 47 per cent of fairtrade farmers are

coffee producers. Tea ranks a little bit lower at the 5th place in sales statistics and accounts

for 20 per cent of all fairtrade producers (Statista, 2016a, c). Against this backdrop, the

current study based on homescan panel data from 2004 to 2008 is unique in size and to the

point of the German beverage market.

In Table I, descriptive statistics of the variable used in the empirical estimations are

given, based on daily product purchases. Relatively to the high number of observations,

products with a fairtrade label are very rare in the GfK panel, with an average share of lower

than one per cent. This should not be surprising taking the time period into account. At the

time only a few fair-traded products were available in the German shopping markets.

The same applies to organic products with an observation average of about 2.5 per cent,

also. It is particularly interesting to note that branding is more important within the coffee

industry than it seems to be for tea products. Since varied roasting and feeding of diverse

flavours lead to highly differentiated products in the coffee industry, tea, on the other hand,

is less about complex process units than about adding a flavour to the original main

product. Hence, branding is more likely about the image than about product differentiation

within the tea market. Moreover, organic farming is more important within the tea market

than in the coffee market. A plausible explanation could be a difference between consumer

groups and the medical application of some teas.

The deflated[4] average prices for coffee, portions, espresso, and tea were 6.07, 14.86,

13.03, and 37.06 EUR per kg, while more than half of the products within the sample were

bought in discounters.

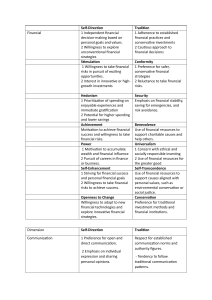

Also regarding Figure 1, it becomes apparent that the average price (EUR/kg) is highest

for tea and the coffee prices rise with a higher level of manufacture (order: ground, espresso,

and single-serve coffee). Hence, the price for manufactured coffee products increases subject

to higher product costs, respectively, with increasing production costs. As mentioned before

the relative price levels for coffee and tea seem to be very steady over time. Meanwhile, the

1804

BFJ

119,8

fluctuations of tea are a little more distinct in comparison to coffee prices. A plausible

explanation could be a seasonal deviation in the production of the agricultural commodity,

namely, tea. This assumption is confirmed by the periodic sequences, as price fluctuations

are nearly at the same level and occur all five to ten months. This can also be seen in Table I

since the tea frequency of purchase per season reaches from 0.23 per cent in spring to

0.31 per cent in Winter. On the contrary, the seasonal variation in case of coffee products is

less definite, because of differences in the harvest.

Furthermore, it must be kept in mind that even overall prices fluctuate within delimited

bounds the standard deviation between coffee, portions, espresso, and tea products is of

60

50

40

30

20

10

0510

15 20 25 30 35 40 45 50 55 60

month

pricecoffee

priceportion

priceespresso

pricetea

EUR per kg

Source: Authors’ calculations using the GfK ConsumerScan (2004-2008) data

Figure 1.

Real price

development in the

period from

January 2004 to

December 2008

Variables Unit Coffee Portions Espresso Tea

Price Real in EUR/kg 6.07 (1.45) 14.86 (6.34) 13.03 (3.15) 37.06 (28.93)

Trend Monthly ( January 2004 ¼1) 32.1 (16.9) 42.0 (13.0) 31.5 (16.7) 33.2 (16.0)

Spring DV (RC: Winter) 0.25 (0.43) 0.24 (0.43) 0.24 (0.43) 0.23 (0.42)

Summer DV (RC: Winter) 0.24 (0.43) 0.24 (0.42) 0.26 (0.44) 0.19 (0.39)

Fall DV (RC: Winter) 0.27 (0.44) 0.28 (0.45) 0.24 (0.42) 0.28 (0.45)

Winter DV (RC) 0.24 (0.43) 0.24 (0.43) 0.27 (0.44) 0.31 (0.46)

December DV (RC: January to November) 0.10 (0.29) 0.11 (0.31) 0.10 (0.30) 0.10 (0.29)

Specialty stores DV (RC: discounter) 0.01 (0.12) 0.01 (0.09) 0.05 (0.22) 0.01 (0.08)

Other stores DV (RC: discounter) 0.02 (0.15) 0.04 (0.20) 0.04 (0.20) 0.01 (0.12)

Supermarkets DV (RC: discounter) 0.04 (0.20) 0.02 (0.15) 0.02 (0.15) 0.07 (0.26)

Hypermarkets DV (RC: discounter) 0.32 (0.46) 0.36 (0.48) 0.37 (0.48) 0.28 (0.45)

Discounter DV (RC) 0.61 (0.49) 0.57 (0.49) 0.51 (0.50) 0.63 (0.48)

Promotion DV (RC: standard price) 0.36 (0.48) 0.16 (0.37) 0.09 (0.29) 0.03 (0.18)

Transport costs Distance

a

in km 3.6 (51.7) 282.8 (352.3) 540.8 (588.5) 11.2 (114.8)

Pack size In kg 0.50 (0.05) 0.15 (0.06) 0.26 (0.08) 0.02 (0.01)

Brand DV (RC: private label) 0.85 (0.35) 0.83 (0.37) 0.84 (0.36) 0.66 (0.47)

Organic DV (RC: non-organic) 0.01 (0.10) 0.01 (0.08) 0.03 (0.16) 0.05 (0.22)

Fairtrade DV (RC: non-fair trade) 0.01 (0.09) 0.00 (0.04) 0.04 (0.18) 0.00 (0.03)

Observations 459,295 64,099 10,613 148,351

Notes: DV, dummy variable; RC, reference-category.

a

Distance from the capital city of products origin to Berlin

Source: Authors’calculations using the GfK ConsumerScan (2004-2008) data

Table I.

Descriptive statistics

of mean (standard

deviation)

1805

Ethical food

labels

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

1

/

14

100%