Analyse économique macro (2ème année)

Analyse économique macro (2ème année)

Série d'exercices 5 - Hiver 2003/2004

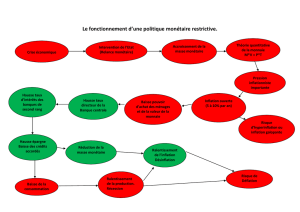

Professeur : A. Pommeret / Assistant : L. Angeles

1.- L'équilibre simultané sur le marché des biens et services et sur le marché de la monnaie

On considère une économie fermée décrite par les équations suivantes:

T=0.1 Y

C= 50+0.8 Yd

I = 100-50i

L= 0.8 Y-1000i

T représente les impôts, Y le revenu réel, C la consommation réelle, Yd le revenu réel disponible, I

l'investissement réel, i le taux d'intérêt, L la demande réelle d'encaisse monétaire, P le niveau général

des prix. On notera (M/P) l'offre réelle de monnaie et G les dépenses gouvernementales réelles. Pour

les 5 premières questions de l'exercice, on supposera que le niveau général des prix est égal à 1.

1) Commentez les équations

2) Définissez les courbes IS et LM. Déterminez les expressions du revenu réel et du taux d'intérêt

d'équilibre en fonction de (M/P) et de G.

Application numérique : M=600 et G=100

3) Calculez l'effet d'une politique budgétaire puis celui d'une politique monétaire sur les niveaux du

revenu et du taux d'intérêt. Expliquez les mécanismes de transmission.

4) Déterminez le multiplicateur des dépenses publiques dans le cas d'une économie sans marché de

la monnaie, puis le multiplicateur de l'offre réelle de monnaie dans le cas d'une économie sans marché

des biens et services. Comparez avec les multiplicateurs obtenus dans la question précédente.

5) Les impôts sont maintenant forfaitaires, et notés simplement T. Déterminez les effets d'une

politique monétaire, d'une politique budgétaire, puis d'une politique fiscale. Expliquez les mécanismes

de transmission liés à la politique fiscale.

6) Sachant que le budget de l'état est équilibré, donnez l'expression de la fonction de demande

agrégée.

2.- Investissement et politique monétaire

Considérons le modèle de l'économie suivant:

AD: Y = c*( M - P ) avec c > 0

AS: P = a + b*Y avec a,b > 0

Remarque : AD est l'"aggregate demand" et représente la demande globale ; AS est l'"aggregate

supply" et représente l'offre globale.

a) Initialement la masse monétaire est égal à M0. Quel sont le niveau de production et le prix

d'équilibre?

Supposez que pour augmenter l'investissement, la banque centrale décide de poursuivre une politique

monétaire expansionniste et double la masse monétaire: M1 = 2*M0.

b) Quel sera le niveau de production avant ajustement du niveau des prix?

c) Que devient l'investissement dans ce cas?

d) Quel sera le niveau de production après ajustement des prix?

e) Qu'en est-t-il de l'investissement?

3.- Revenu et consommation permanente

On considère un ménage percevant un salaire pendant quatre périodes: Y1 = 500 ; Y2 = 1000 ; Y3 =

1000 ; Y4 = 800. Ce ménage possède en outre au début de la période 1 un patrimoine P0 de 500 qu'il

place au taux d'intérêt en vigueur i = 10 % pendant les quatre périodes considérées (il reçoit donc des

intérêts dès la première période). Sachant que le ménage utilise ce patrimoine et les intérêts qu'il

rapporte pour améliorer son niveau de vie (le patrimoine détenu en fin de quatrième période retombe à

0) : a) Définissez et déterminez le revenu permanent du ménage.

b) Calculez la consommation permanente de ce ménage.

c) On définit l'épargne du ménage à chaque période St :

St = Yt + iPt-1 - Ct

Construisez un tableau mettant en évidence à chaque période les évolutions conjointes du

patrimoine initial, des revenus, de la consommation, de l'épargne et du patrimoine résiduel de fin

de période. Quelles remarques vous suggèrent ces évolutions?

4.- La mort du pacte de stabilité européen.

Le "Pacte de stabilité" de l'Union Européenne établit que les états membres ne doivent pas avoir un

déficit budgétaire supérieur à 3 % du PIB. Selon l'article de "The Economist" ci-dessous, le pacte est

maintenant mort après que l'Allemagne et la France ont décidé de ne pas l'obéir. Lisez l'article et

répondez aux questions qui suivent.

Unpicking the fiscal straitjacket

Nov 27th 2003

From The Economist Global Agenda

France and Germany have escaped punishment under the stability pact for their

big budget deficits. The pact itself may not escape a long-awaited demise

NEVER has a straitjacket seemed so ill-fitting or so insecure. The euro area’s “stability

and growth pact” was supposed to stop irresponsible member states running excessive

budget deficits, defined as 3% of GDP or more. Chief among the restraints was the threat

of large fines if member governments breached the limit for three years in a row. For

some time now, no one has seriously believed those restraints would hold. In the early

hours of Tuesday November 25th, the euro’s fiscal straitjacket finally came apart at the

seams.

The pact’s fate was sealed over an extended dinner meeting of the euro area’s 12 finance

ministers. They chewed over the sorry fiscal record of the euro’s two largest members,

France and Germany. Both governments ran deficits of more than 3% of GDP last year

and will do so again this year. Both expect to breach the limit for the third time in 2004

(see chart below). Earlier this year the European Commission, which polices the pact,

agreed to give both countries an extra year, until 2005, to bring their deficits back into

line. But it also instructed them to revisit their budget plans for 2004 and make extra

cuts. France was asked to cut its underlying, cyclically adjusted deficit by a full 1% of

GDP, Germany by 0.8%. Both resisted.

Under the pact’s rules, the commission’s prescriptions have no force until formally

endorsed in a vote by the euro area’s finance ministers, known as the “eurogroup”. And

the votes were simply not there. Instead, the eurogroup agreed on a set of proposals of

its own, drawn up by the Italian finance minister, Giulio Tremonti. France will cut its

structural deficit by 0.8% of GDP next year, Germany by 0.6%. In 2005, both will bring

their deficits below 3%, economic growth permitting. Nothing will enforce or guarantee

this agreement except France and Germany’s word. The European Central Bank (ECB)

was alarmed at this outcome, the commission was dismayed, and the smaller euro-area

countries who opposed the deal were apoplectic: treaty law was giving way to the

“Franco-German steamroller”, as Le Figaro, a French newspaper, put it.

a) Dans l'article le Pacte de Stabilité est décrit comme un "straitjacket" (une camisole de force).

Pourquoi ?

b) Dans le dernier paragraph il est dit : " In 2005, both will bring their deficits below 3%,

economic growth permitting" . Pourquoi est-ce que la croissance économique est

importante pour que cette promesse soit tenue ?

1

/

4

100%