12 Essential Stock Tips & Recommendations for Market Investors

Telechargé par

Robert Jackson

12 Essential Stock Tips & Recommendations for Market Investors

The financial exchange is perhaps the best spot to develop your riches. In any case, as opposed to

what numerous individuals let you accept, it's anything but a simple and speedy cash attempt. Without

the correct information, abilities, and order, you might conceivably wind up losing cash. Here are some

fundamental stock tips you should know to help you become effective in your contributing excursion.

1. Decide whether you are equipped for putting resources into stocks.

Most importantly, you should see whether you should put resources into stocks. Try not to go looking

through online for investment opportunities tips first. In the event that you put resources into stocks

while you're as yet not prepared, it very well may be a catastrophe waiting to happen. You need to

comprehend that the securities exchange is a type of venture. Along these lines, you need to have a

steady pay first before considering taking speculation chances. Would you be able to cover your month

to month bills and costs without a whine?

Additionally, you ought to have a secret stash and reserve funds nearby. You should just be putting

away your extra cash. In the event that you can scarcely make a decent living, at that point you

shouldn't be circumventing putting resources into the financial exchange. Preferably, you need to

have a solid spending that you follow. This is a decent sign that you're monetarily steady and fit for

making speculations. In the event that you actually don't have these prepared, it may not be your time

yet.

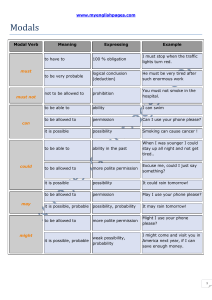

2. Know the jargon.

At the point when you're simply first getting into the financial exchange, there are a lot of terms that

would sound profoundly new. Generally, they even appear to be scaring which makes individuals avoid

really pushing through. Learning the essentials - even down to the jargon is critical. When you know

the jargon, it will be a lot simpler for you to expand on that information. Besides, you won't actually

feel threatened in light of the fact that you know a great deal.

3. Fabricate your essential information.

So you have the jargon down. Presently, it's an ideal opportunity to expand on that establishment.

This is the ideal chance to look into stock tips and investment opportunities tips to fill in as a guide.

The brilliant guideline in venture is to never put your cash into something you don't totally

comprehend.

4. Comprehend the dangers.

Most speculations accompany a danger. It implies that on the off chance that you put your cash in the

securities exchange, quite possibly you won't get a similar measure of cash back once more. This is

against putting your cash in an investment account in a bank or a low-yield security.

Understanding the dangers implies distinguishing your danger resilience. Your capacity to bear hazard

is frequently controlled by your age, pay, speculation objectives, and solace level. For instance, a

solitary 28-year elderly person who procures $80,000 per year, hoping to develop his abundance, can

be more forceful with his ventures. In the interim, a wedded 58-year elderly person who acquires

$150,000 a year hoping to develop his cash for retirement may not be as forceful.

5. Begin exchanging.

Generally, individuals get gotten up to speed looking for Stock Options Tips and ultimately neglect to

try and start. It's one of the ideal instances of losing even prior to beginning. While it's consistently

savvy to set yourself up prior to contributing, it's significant that you start.

Numerous individuals are regularly frightened or reluctant. Maybe they believe it's not the perfect

time or they need more cash. Notwithstanding, looking into stocks and never really putting cash is

simply burning through your significant time. On the off chance that you've done your examination

and you're just putting away cash that you can stand to lose, at that point you should feel free to

contribute.

6. Do your examination and be aware of everything.

There is a lot of securities exchange data you can discover on the web. Online specialists frequently

discharge their market investigation routinely. It is anything but an impractical notion to depend on

these investment opportunity tips now and again. All things considered, these tips were made by the

specialists. Nonetheless, this isn't a reason to not accomplish the work.

Don't simply aimlessly follow investment opportunities tips given by others - particularly on the off

chance that they are simply simple financial specialists like you. Try not to put resources into

something in light of the fact that your collaborator or relative does. Never put resources into

something since somebody you know brought in some cash from it. You ought to actually realize why

you're putting resources into a specific stock.

7. Keep learning.

Maybe you've been contributing for a long while now. Your portfolio is solid and you feel like

everything is great. This shouldn't prevent you from persistently studying the securities exchange.

Also, you shouldn't quit staying up with the latest with recent developments. Recollect that anything

that occurs on the planet can altogether influence any organization you've put resources into. Never

feel presumptuous about what you know. Converse with others, understood news, and know about

what's going on with your nation's economy.

8. Dread and Greed

Two of the primary destructions of a securities exchange financial specialist are dread and eagerness.

Feelings will consistently be something you need to put aside when putting resources into the

securities exchange. Shockingly, numerous individuals capitulate to them which ultimately prompts

their defeat.

For instance, if an individual puts resources into Stock An and the stock unexpectedly plunges for

reasons unknown. Dread will quickly set in and along these lines, he would rashly pull out his stocks,

losing cash over it. Be that as it may, the next month, the stock recuperates and over the long haul

really increments in worth. The individual has lost a wise venture out of dread.

Despite what might be expected, voracity can likewise set in. An individual can place the entirety of

his cash into one stock since it's been performing admirably for quite a long time. In any case, any

quake in the economy can fundamentally cut down the securities exchange. You can wind up losing

cash that you can't bear to lose on the off chance that you become eager.

9. Investigate your stocks.

Finding some kind of harmony of observing your stocks is vital. In a perfect world, you should screen

your stocks and not simply leave it for quite a long time. In case you're a drawn out speculator,

checking at any rate once at regular intervals is fine. For long haul ventures like retirement, you can

check at regular intervals.

In any case, the more normal misstep is observing excessively. You don't need to determine the status

of your stocks regular except if you're an informal investor. This will just allow you to follow up on rash

feelings that can destroy your venture. You should have the option to go on with your typical life even

with a portion of your cash put resources into the securities exchange.

10. Adhere to the great stocks.

In spite of the fact that the financial exchange is frequently inclined to unpredictability, there is an

approach to adhere to the protected side. You can do as such by putting resources into the great

stocks. These stocks are the top performing stocks for as far back as many years. You can without

much of a stretch discover what these organizations are. It's actually up to you which ones you believe

merit putting resources into.

Notwithstanding, this doesn't imply that you can't accepting stocks from different organizations. You

absolutely can insofar as you've done the correct exploration and you can endure the danger. On the

off chance that you need to play safe, you shouldn't mess about and adhere to the surest stocks.

11. Enhance your portfolio.

You will frequently hear this tip from the individuals who additionally put resources into the securities

exchange. It's like not tying up your assets in one place. In a perfect world, you ought not simply get

one stock with the entirety of your venture cash. It advises you to purchase a lot of various high-

performing stocks rather than only one. That way, on the off chance that one stock drops, you

wouldn't have lost all your cash. Having an assorted portfolio gives you a security net if at any point

anything happens to all your different stocks.

This tip additionally likewise urges you to have other venture alternatives separated from the

securities exchange. This could be land, bonds, or depository bills. On the off chance that you can, you

ought to put your cash in different zones, as well. The financial exchange isn't the solitary spot to

develop your abundance.

12. Be sensible.

Maybe you've found out about somebody who quit his normal everyday employment to exchange

stocks. That it is so great to never work a day in your life and just let your cash work for you. While

this is totally conceivable, this shouldn't be the desire for all financial specialists. Numerous tenderfoot

financial specialists will in general get exceptionally frustrated when they discover that the securities

exchange isn't an easy money scam. Along these lines, many will in general quit contributing and

simply proceed onward with another speculation adventure. This bombs them to receive the

numerous rewards of the securities exchange.

While getting into the financial exchange, speculators ought not anticipate bringing in a lot of cash in

a brief period. Without rushing should be the movement you're going for.

These are just a portion of the 12 fundamental stock tips you need to know whether you're simply

beginning or have quite recently begun putting resources into the securities exchange. When you

figure out how to apply these tips, you're bound to prevail in this undertaking. The key is continually

settling on educated choices while applying discipline.

For More Info Visit Us:- https://www.shyamadvisory.com/

Business Email Address: [email protected]

Business Phone Number: 0281-6199999

Business Address: Shyam House Nr. Ambika park society,

Hanuman Madhi Chowk, Raiya Road, Rajkot, Gujarat, India,

360007

1

/

5

100%