1

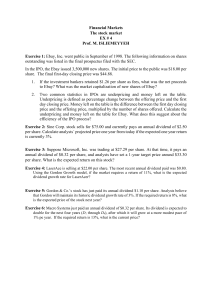

Chapter 4 ▪The Stock Market

▪Further readings:

▪Frederic Mishkin, Stanley Eakins, Financial Markets and Institutions, chapters 13.

2

Motivation

In August of 2004, Google went public, auctioning its shares in an unusual

IPO format. The shares originally sold for $85 / share, and closed at over

$100 on the first day. At the end of 2012, shares are trading on Nasdaq at

over $707 / share.

3

Topics Addressed

1. Stock Market Indexes

2. Regulation of the Stock Market

3. Investing in Stocks

4. Computing the Price of Common Stock

5. How the Market Sets Security Prices

6. Errors in Valuation

4

Investing in Stocks

1. Represents ownership

in a firm

2. Earn a return in

two ways

–Price of the stock rises

over time

–Dividends are paid to the

stockholder

3. Stockholders have claim on

all assets

4. Right to vote for directors and

on certain issues

5. Two types

–Common stock

▪Right to vote

▪Receive dividends

–Preferred stock

▪Receive a fixed dividend

▪Do not usually vote

5

Stock Market Indices

▪Stock market indexes are frequently used to monitor the behavior of a groups

of stocks.

▪Major indexes include the Dow Jones Industrial Average, the S&P 500, and

the NASDAQ composite.

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

26

26

27

27

28

28

29

29

30

30

1

/

30

100%