Investment Management

Easter 2018

Eric Dyke

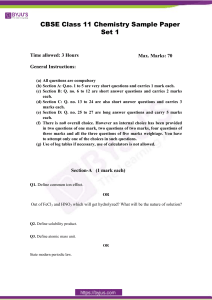

Limit-

Buy

Order

Stop-

Buy

Order

Stop-

Loss

Order

Limit-

Sell

Order

Action

Price below

the limit

Price above

the limit

Buy

Sell

Condition

Market orders Buy or sell at the best current price

Limit orders specify limits

on the maximum buy or

minimum sell price

Stop loss: Contingent order for someone wishing to

protect a profitable long position, or limit its losses,

if it drops to a given price. It then becomes a market

order; it does not guarantee sale price.

Stop buy order Contingent

order for someone wishing

to protect a profitable

short position, or limit its

losses, if it rises above a

given price. It then

becomes a market order; it

does not guarantee

purchase price

1a. Explain the difference between a stop buy order

and a stop loss order. (7 marks)

Question 1a

Stop buy order definition

3

Stop loss order definition

3

Both are for exiting positions / limiting losses

1

You are given the following option prices on a stock, which is currently trading

at 100. A 1-year call with exercise price 90 is valued at 26 and a 1-year put with

exercise price 90 is valued at 10; and a 1-year call with exercise price 110 is

valued at 18 and a 1-year put with exercise 110 is valued at 13. Demonstrate

whether there are arbitrage opportunities? (9 marks)

Arbitrage free, require PV(X) = S+P-C

Assuming rf = 0% and arbitraging

both sides of put-call parity equation

is incorrect but was worth 2 marks

Present profit on trading future sum of

100 is 93.33-86.36 = 6 .97

X

C+X/(1+r

f

)

S+P

90 116.00 >

110.00

110 128.00 >

113.00

Borrow at low rate and lend at

higher rate

Call

Put

S

X

26

10

100

90

18

13

100

110

Question

1b

Implicit

rf for 90 (Or NPV comparison

) 7.14% (0.933)

3

Implicit

rf for

110 15.79% (0.864)

3

Opportunity for arbitrage?

3

Buy future money (lend) at low price

and sell (borrow) at high price

Future profit on trading present

sum of 100 is 15.79 -7.14 = 8.647

97.69333.0)4675.7(93.33 toScaled

= 0.9333

= 0.8636

= 7.4675

PV(X)

rf

84.00

7.14%

95.00

15.79%

You are given the following information about a portfolio, denoted A, and the

market portfolio. The risk free rate is 3%.

According to the Treynor-Black model, the optimal mix of the A and market

portfolios for variance-averse investors is given by the formula

In this formula, w* is the weight on portfolio A, αA is Jensen’s alpha of portfolio A,

βA is the beta of portfolio A, rm is the expected return on the market portfolio, rf is

the risk free return, Var(eA) is the idiosyncratic risk of portfolio A, and σm2 is the

variance of the market portfolio. Work out the optimal weight w*. (9 marks)

Portfolio A Market portfolio

Expected return 10% 8%

Variance 12% 9%

Beta 0.8 1

Question

1c

Alpha 3%

3

Idiosyncratic risk

6.24%

3

W* =

0.74 and passive 0.26 9 marks for this

3

))(( fmAfAA rrβr-rα

%3%))5(8.0%3( %10 -

2222 mAAeA

%24.6%)9(64.0%12

And hold 26% in the market portfolio.

=

=

= 0.74

Var(eA) =

5

How does the expectations hypothesis differ from the

segmentation hypothesis as a theory of the term

structure of interest rates?

(7 marks)

Question 2a

Expectations hypothesis

3

Segmentation theory

3

Differences

1

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

26

26

27

27

28

28

29

29

30

30

31

31

32

32

33

33

34

34

35

35

1

/

35

100%