ucalgary_2014_Tertychnyi_Maksym.pdf

UNIVERSITY OF CALGARY

Modeling of Currency Trading Markets and Pricing Their Derivatives in a Markov

Modulated Environment

by

Maksym Tertychnyi

A THESIS

SUBMITTED TO THE FACULTY OF GRADUATE STUDIES

IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE

DEGREE OF MASTER OF SCIENCE

DEPARTMENT OF MATHEMATICS AND STATISTICS

CALGARY, ALBERTA

May, 2014

c

Maksym Tertychnyi 2014

Abstract

Using a L´evy process we generalize formulas in Bo et al. (2010) to the Esscher transform

parameters for the log-normal distribution which ensures the martingale condition holds for

the discounted foreign exchange rate. We also derive similar results, but in the case when

the dynamics of the FX rate is driven by a general Merton jump-diffusion process.

Using these values of the parameters we find a risk-neural measure and provide new

formulas for the distribution of jumps, the mean jump size, and the Poisson process intensity

with respect to this measure. The formulas for a European call foreign exchange option are

also derived.

We apply these formulas to the case of the log-double exponential and exponential distri-

bution of jumps. We provide numerical simulations for the European call foreign exchange

option prices with different parameters.

i

Acknowledgements

I am happy to take this opportunity to express my gratitude to my research supervisors

Professor Anatoliy Swishchuk and Professor Robert Elliott. They introduced me to the new

(for me) area of Mathematical Finance, gave many valuable remarks, and made suggestions

for improvements. I am grateful for their attention to my thesis preparation and technical

comments.

ii

Table of Contents

Abstract ........................................ i

Acknowledgements .................................. ii

TableofContents.................................... iii

ListofFigures...................................... iv

ListofSymbols ..................................... v

1 Introduction.................................... 1

2 Literaturereview ................................. 4

3 L´evyProcesses .................................. 20

3.1 L´evy processes. Basic definitions and theorems . . . . . . . . . . . . . . . . . 20

3.2 Characteristic functions of L´evy processes . . . . . . . . . . . . . . . . . . . 22

3.3 Itˆo’s formula with jumps and its applications . . . . . . . . . . . . . . . . . . 23

3.4 Girsanov’s theorem with jumps . . . . . . . . . . . . . . . . . . . . . . . . . 25

4 Currencyderivatives ............................... 26

4.1 Types of currency derivatives . . . . . . . . . . . . . . . . . . . . . . . . . . 26

4.1.1 Forwardcontracts............................. 26

4.1.2 Currencyfutures ............................. 28

4.1.3 Currencyoptions ............................. 30

4.2 Purecurrencycontracts ............................. 31

5 Currency option pricing. Main results . . . . . . . . . . . . . . . . . . . . . . 39

5.1 Currency option pricing for general L´evy processes . . . . . . . . . . . . . . 39

5.2 Currency option pricing for log-double exponential processes . . . . . . . . . 48

5.3 Currency option pricing for log-normal processes . . . . . . . . . . . . . . . . 52

5.4 Currency option pricing for Merton jump-diffusion processes . . . . . . . . . 54

5.5 Currency option pricing for exponential processes . . . . . . . . . . . . . . . 61

6 NumericalResults................................. 63

6.1 Log-double exponential distribution . . . . . . . . . . . . . . . . . . . . . . . 63

6.2 Exponential distribution . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

Bibliography ...................................... 71

7 Apendix ...................................... 76

iii

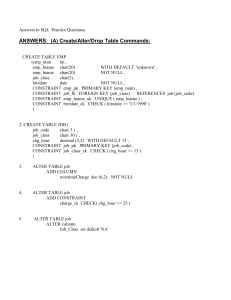

List of Figures and Illustrations

5.1 Double-exponential distribution (green) vs. normal distribution (red), mean=0,

dev=2 ....................................... 50

6.1 S0= 1, T = 0.5, θ1= 10, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 65

6.2 S0= 1, T = 1.0, θ1= 10, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 65

6.3 S0= 1, T = 1.2, θ1= 10, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 66

6.4 S0= 1, T = 0.5, θ1= 5, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 66

6.5 S0= 1, T = 1.0, θ1= 5, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 67

6.6 S0= 1, T = 1.2, θ1= 5, θ2= 10, p = 0.5,mean normal = 0,sigma normal = 0.1 67

6.7 S0= 1, T = 0.5, θ2= 10, p = 0.5 ......................... 68

6.8 Option price of European Call: S0= 1, T = 0.5, p = 0.5............ 68

6.9 Option price of European Call: θ=5...................... 69

6.10 Option price of European Call: θ= 3.5..................... 69

6.11 Option price of European Call: θ= 2.5..................... 70

iv

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

26

26

27

27

28

28

29

29

30

30

31

31

32

32

33

33

34

34

35

35

36

36

37

37

38

38

39

39

40

40

41

41

42

42

43

43

44

44

45

45

46

46

47

47

48

48

49

49

50

50

51

51

52

52

53

53

54

54

55

55

56

56

57

57

58

58

59

59

60

60

61

61

62

62

63

63

64

64

65

65

66

66

67

67

68

68

69

69

70

70

71

71

72

72

73

73

74

74

75

75

76

76

77

77

78

78

79

79

80

80

81

81

82

82

83

83

84

84

85

85

86

86

87

87

88

88

89

89

90

90

91

91

92

92

93

93

94

94

95

95

96

96

97

97

1

/

97

100%

![[orsc.edu.cn]](http://s1.studylibfr.com/store/data/009795977_1-4d24673b0ce7de50138edd43e29ab49c-300x300.png)

![[www.optioncity.net]](http://s1.studylibfr.com/store/data/008976874_1-74673f21f4d6be12aadb07b7c11410d8-300x300.png)

![[orsc.edu.cn]](http://s1.studylibfr.com/store/data/009795976_1-58b950a79db382ec7d2e8f7b8b2946ac-300x300.png)