La déduction pour capital à risque

La déduction pour capital à

risque

Christian VALENDUC

Service d’Etudes SPF Finances, UCL

et FUCAM

La déduction pour capital à risque

Les mérites de la réforme

Le processus politique

Quid des effets ?

Les mérites de la réforme

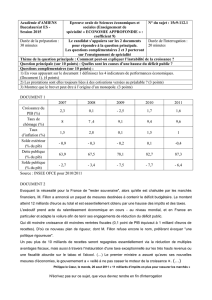

Two main distorsions to be addressed

Taxation of marginal investment

Discrimination between debt and equity

Les mérites de la réforme

Non-taxation of the

marginal investment

By not taxing at the

margin, the

Allowance for

Corporate Equity

(ACE) brings I back

from I1to I0

So you get the “no

tax case”, with part of

the tax revenue

CIT becomes a tax on

pure profits

(economic rents).

I0

I1

rw

Rw/(1-t)

Les mérites de la réforme

No tax on the

marginal

investment

CIT only levied on

economic rents

Equal treatment of

debt and equity

The benefits of the

ACE don’t need to be

extended to the

existing stock of

equity capital

If extended, it

creates a windfall

gain for existing

shareholders

6

6

7

7

8

8

9

9

10

10

11

11

12

12

13

13

14

14

15

15

16

16

17

17

18

18

19

19

20

20

21

21

22

22

23

23

24

24

25

25

26

26

1

/

26

100%