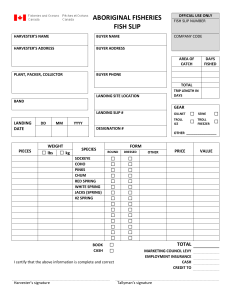

LETTER OF CREDIT TYPE

PAYMENT TERM

Bastien Tartu, Antoine Mayer, Baryan Regragui, Fleur Algoud, Rania

Nehali, Chloe Fitzgerald

The topics for discussion

What we’re going to talk

about

Definiton

Process

Use

Advantages and disadvantages

International trade

Definiton

There are five commonly used types of

letter of credit. Each has different

features and some are more secure than

others. Sometimes a letter of credit may

combine two types, such as 'confirmed'

( an additional guarantee to the original

letter of credit obtained by a borrower

from a second bank) and 'irrevocable'.

There are two main types of letters of credit:

Revocable Letter of Credit:

This type of letter of credit can be cancelled or

modified by the issuing bank at any time without

prior notice to the beneficiary (seller). However, this

type of letter of credit is rare and not widely used.

Irrevocable Letter of Credit:

This type of letter of credit cannot be cancelled or

modified without the agreement of all parties

involved, including the beneficiary, the issuing

bank, and the buyer. This provides a level of

security to the seller that they will be paid for their

goods or services, as long as they meet the

conditions specified in the letter of credit.

Type of letter of credit

Description

Standby

A standby letter of credit is an assurance from a

bank that a buyer is able to pay a seller. The seller

doesn't expect to have to draw on the letter of

credit to get paid.

Back-to-back

Back-to-back letters of credit may be used when an

intermediary is involved but a transferable letter of

credit is unsuitable.

6

6

7

7

8

8

9

9

10

10

1

/

10

100%