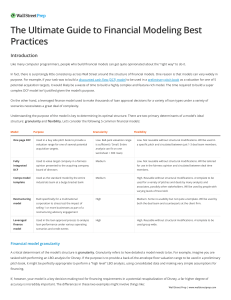

Commonapproachetoforecatingalanceheetlineitemwhenuildinga3

tatementmodel

‑‑

LineItem(ee

formulaaove) Howtoforecat

LineItem(ee

formulaaove) Howtoforecat

Deferred

taxaet

Deferred

tax

liailitie

Newtockiuance(IPOorecondaroering)

tock-aedcompenation

6

6

7

7

8

8

1

/

8

100%